Executive Insights

Read valuable and timely articles from our executive team of experts to further your precious metals and coin knowledge.

Our Executive Authors

Philip Diehl

President

Philip N. Diehl is the president of U.S. Money Reserve and a published analyst of the precious metals markets. As 35th Director of the U.S. Mint (1994–2000), Diehl oversaw one of the most impressive government agency turnarounds in recent U.S. history through new product initiatives, increased oversight, strategic reorganization, and fiscal responsibility. His experience and expert knowledge in the field of precious metals strengthens U.S. Money Reserve’s commitment to a superior customer experience.

Edmund C. Moy

Senior IRA Strategist

Edmund C. Moy collaborates with U.S. Money Reserve as Senior IRA Strategist. A recipient of the Alexander Hamilton Medal for public service, awarded to him by then-Treasury Secretary Henry M. Paulson, Jr., Moy served as the 38th Director of the United States Mint (2006–2011). Among many accomplishments during his tenure, Moy oversaw one of the largest increases in volume of precious metals output in Mint history, as Americans turned to safe-haven assets in the wake of the Great Recession.

Angela Roberts

CEO

Chief Executive Officer Angela Roberts joined U.S. Money Reserve in 2003. Roberts has held numerous positions within the organization, culminating in her promotion to CEO in 2015. She is credited with creating the analytic and KPI structure at U.S. Money Reserve. Believing strongly that the people make the business, Roberts has positioned U.S. Money Reserve to be a trusted precious metal leader that always puts their customers and employees first. Learn more in her interview with Forbes.

John Rothans

Master Numismatist

Chief Procurement Officer and Master Numismatist John Rothans has been a key fixture in the numismatic industry for over 30 years. Rothans joined U.S. Money Reserve as a consultant in 2004, eventually becoming Chief Procurement Officer and overseeing all wholesale operations, new product lines, and coin strategy. Rothans is credited with the development, production, and distribution of proprietary product offerings, including U.S. Money Reserve’s best-selling Pearl Harbor and Iwo Jima coin series.

Brad Chastain

Director of Education

Brad Chastain joined U.S. Money Reserve as Director of Education after spending 18 years at Vanguard, one of the world’s largest and most respected investment firms. As a leader in Vanguard’s employee plan retirement education business, Chastain managed a team of specialists and was responsible for helping hundreds of thousands of clients plan and prepare for retirement. He and his team provided in-depth training and education on a variety of financial topics ranging from investments, diversification and risk management, to Social Security, Medicare and College Savings Plans. An in-demand speaker and recognized industry thought leader in the areas of retirement planning and wealth management education, Chastain is dedicated to helping U.S. Money Reserve clients reach their financial goals and build more secure futures with precious metals.

Recent Articles

Cryptocurrency May Not Be a Safe Haven, But Here's Why Gold Is

In anything but a cryptic fashion, many market observers are signaling the fall of cryptocurrency and promoting the security of precious metals like gold. A recent CNBC.com article declared that the hot streak that had been enjoyed by bitcoin—the most prominent type of cryptocurrency—is “truly dead.” As a result, people are gravitating...

The Gold IRA: Your Protection in the “Risk Zone”

No one can blame portfolio holders for being nervous these days. As pointed out by the World Gold Council (WGC), 2018 was one of the most volatile years on record for financial markets and the worst-performing year in recent memory. The S&P 500 closed the year down 6.2%, while the Dow Jones fell 5.6%—the biggest losses since 2008....

What Are Gold Prices Trying to Tell Us?

They say everything happens for a reason. This is true in life as well as in the economy. And it’s particularly the case in the commodities market. Gold prices are at a seven-month high. So what is the precious metal trying to tell us? While gold essentially trades on supply and demand, it is also a store of wealth, a historical safe...

The Apple Effect and The Great China Downturn

“Slower growth in China means slower growth for the rest of the world,” blares a BBC Business article. Indeed, recent data has confirmed that the world’s second largest economy grew at 6.4 percent in the fourth quarter of 2018—a pace not seen since the financial crisis of 2008. On Monday, Chinese President Xi Jinping warned that his...

2019 Global Gold Forecast: The Price Influencers & Predictions You Need to Know

The economic outlook for 2019 is filled with warnings of a downturn, with many prominent economists and experts predicting a U.S. recession could start in late 2019 or early 2020. Of particular note are the following three predictions. They’re poised to burden the U.S. economy but be a boon for gold. Ongoing trade tensions could spur...

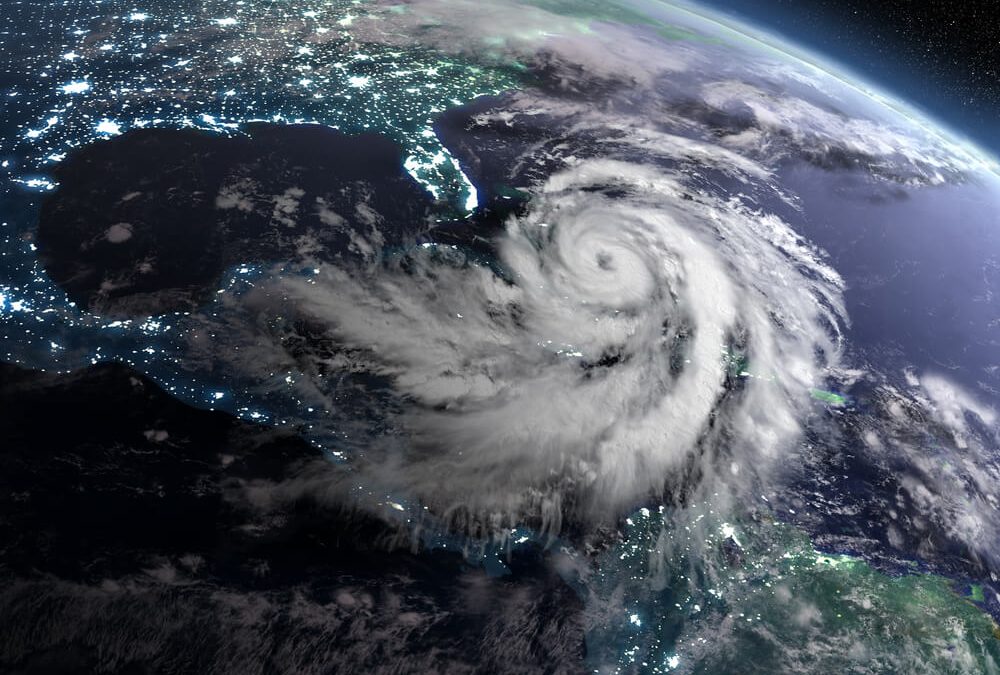

“Darkening Skies”: Global Storm Clouds are Gathering

While the United States grapples with the longest government shutdown on record, there seems to be little common ground among lawmakers and no likely deal in sight. Some 800,000 government workers just missed their first paycheck since parts of the government were shuttered—and there’s increasing pressure on both sides of the...

A New Year. An Old Portfolio. A Questionable Outcome.

The holidays are over. Christmas trees have been tossed to the curb, and we’re finally back to work. It’s 2019, the 19th year of the 21st century and the last year of the 2010s. We are customarily knee-deep in resolutions to lose weight, quit smoking, and get more sleep—but also up to our eyeballs in the fallout from 2018. It was a...

Another December to Remember on Wall Street

Whether it was a faulty GPS or a few queasy reindeer, Santa Claus didn’t make it to Wall Street last year. The financial markets experienced the worst December since the Great Depression. The Dow Jones closed down more than 9%, while the S&P 500 fell almost 10%. Back in December 1931, the Dow sank a record 17%, and the S&P 500...

Are Retirement Pensions Dead?

There was a time when loyalty to an employer meant something. You sacrificed and served your government or company during your working years, and in return, they provided you with some form of retirement security—usually a pension. It was a promise you could count on. A guarantee you could bet your gold watch on! But a decade ago, a...

Is this the Most Volatile Stock Market in History?

To look or not to look, that is the question—particularly if you’re holding stocks in your financial portfolio. Checking in on your retirement account nowadays is no fun, and to say that Wall Street has been uneasy of late is an understatement. The markets have been volatile not only week to week and day to day, but literally minute to...

Canadian Gold Maple Leaf vs. Gold Krugerrand: Is One a Better Buy?

Everyone loves a compelling match-up. Coke vs. Pepsi. McDonald’s vs. Burger King. Floyd Mayweather Jr. vs. Conor McGregor. The list goes on. That phenomenon extends to gold coins. Numismatists and novice precious metal buyers want to know, for example, how the Canadian Gold Maple Leaf stacks up against the South African Krugerrand....

Soaring Global Debt: The Next Black Swan?

Back in 2007, former options trader and New York Times best-selling author Nassim Taleb released a book called The Black Swan: The Impact of the Highly Improbable. In it, Taleb addresses the indiscriminate and often destructive power of unforeseen global events: “It is easy to see that life is the cumulative effect of a handful of...

Find hundreds of reports, articles, videos, and other useful tools to help you become a more educated precious metals owner.

Access Now

Stay up to date and get the latest news and updates impacting the gold and silver markets and precious metals industry.

Learn More