This is the second in a series of posts making the “Main Street” case for gold. Read Part I

I described in my last post how gold’s core value proposition is as wealth insurance. Here I’ll address why understanding gold as wealth insurance, rather than as just another investment vehicle, is crucial to understanding why gold should be a part of most people’s financial planning.

Gold outperforms

How does gold act as wealth insurance? There are countless examples over the centuries, but let’s look at the past 25 years.

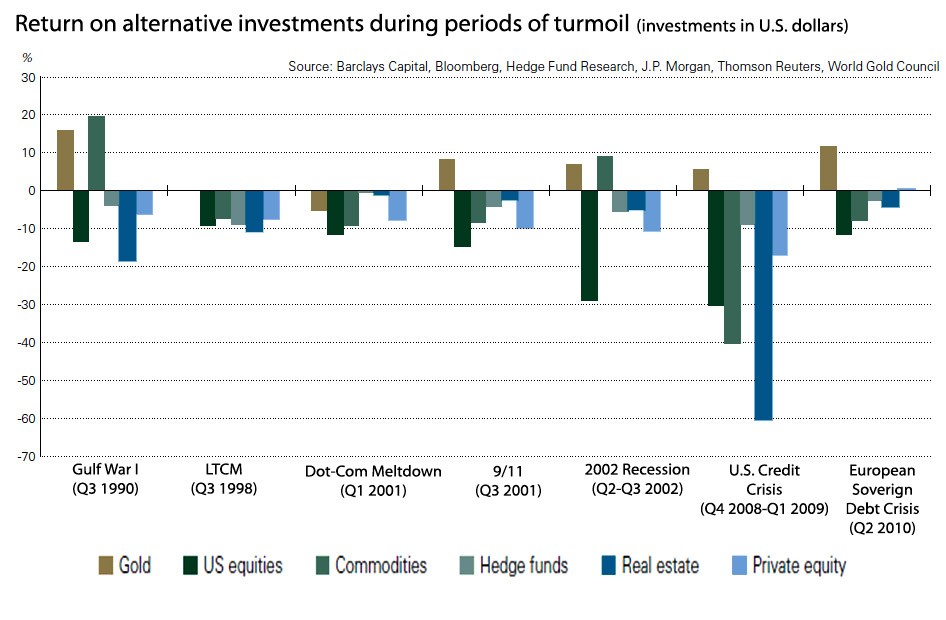

As this graph illustrates, gold has consistently outperformed U.S. stocks, commodities, hedge funds, real estate, and private equity through seven major economic shocks and political crises since 1990.

As this graph illustrates, gold has consistently outperformed U.S. stocks, commodities, hedge funds, real estate, and private equity through seven major economic shocks and political crises since 1990.

And in the biggest crisis, the financial meltdown of 2008 – 2009, the most dangerous economic crisis since the Great Depression, gold prices rose while other investments plummeted.  This is the role physical gold has in a financial portfolio: wealth insurance that offsets other losses, protecting your wealth.

This is the role physical gold has in a financial portfolio: wealth insurance that offsets other losses, protecting your wealth.

Gold’s critics will point out that gold prices can fall, and fall dramatically, like they did after hitting their September 2011 peak. Of course, they’re cherry-picking one 18-month period out of the last 30 years. Over the other 28+ years, gold held its own, and over extended periods during that 30 years, performed extremely well.

Gold is insurance

But to understand gold as wealth insurance, think about other forms of insurance: auto, home, term life. What would your insurance agent say if you asked her how much your policy will be worth after 10, 20, 30 years? She’s going to look at you funny and say something like, “Well, nothing, because insurance isn’t about earning a return, it’s about protection.”

If after paying premiums for 20 or 30 years you’ve never made a claim, you don’t lament spending all that money on insurance. You count your blessings.

The recent decade-long bull market has led us to forget this essential role of gold in a portfolio. Now we think of it solely for its profit potential rather than as wealth protection.

But to understand why gold should be part of a financial portfolio, it’s important to recognize that gold is wealth insurance — with a bonus.

Unlike other forms of insurance, gold not only holds at least a major portion of its value, it can appreciate in value.If you bought gold as wealth insurance 40 years ago, the value of your “policy” today would be worth 12 times what you paid for it. If you bought gold as wealth insurance in 2001, today, your policy would be worth five times what you paid for it, even after gold’s fall off its 2011 peak.

Except for one three-year period over the past 50 years, anyone who bought and held gold is in a profit position today. Said another way, if you bought gold in any of 47 out of the past 50 years, you’ve made money. Your gold insurance is worth more than you paid for it—probably much more.

Critics of gold talk as if gold is the only asset that experiences price declines. Of course, that’s not the case. Stocks, bonds, real estate—all investments—rise and fall in value and none of them are immune to bubbles.

But gold is different. Gold has never lost its entire value. Gold will never be worth $0.