Executive Insights

Read valuable and timely articles from our executive team of experts to further your precious metals and coin knowledge.

Our Executive Authors

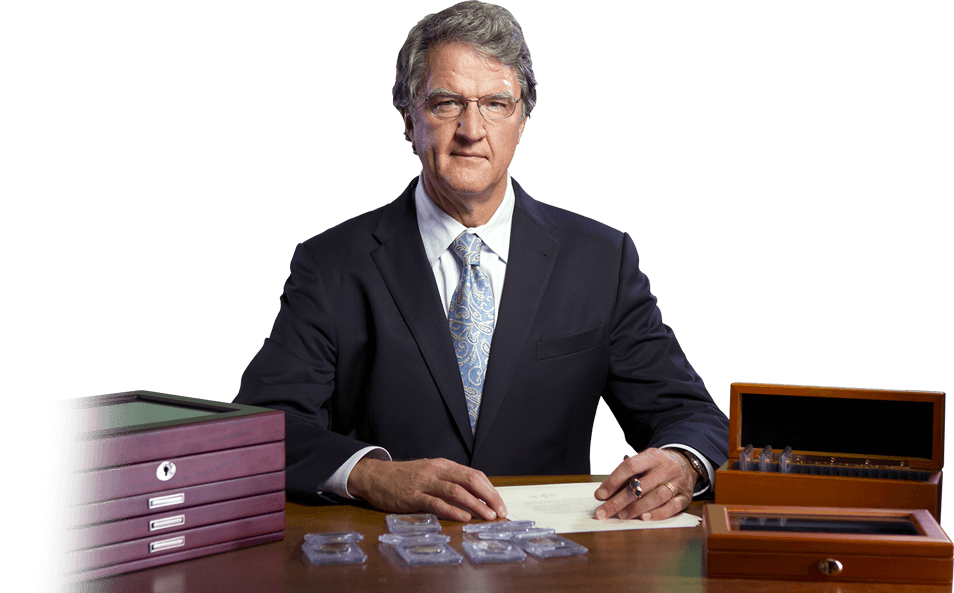

Philip Diehl

President

Philip N. Diehl is the president of U.S. Money Reserve and a published analyst of the precious metals markets. As 35th Director of the U.S. Mint (1994–2000), Diehl oversaw one of the most impressive government agency turnarounds in recent U.S. history through new product initiatives, increased oversight, strategic reorganization, and fiscal responsibility. His experience and expert knowledge in the field of precious metals strengthens U.S. Money Reserve’s commitment to a superior customer experience.

Edmund C. Moy

Senior IRA Strategist

Edmund C. Moy collaborates with U.S. Money Reserve as Senior IRA Strategist. A recipient of the Alexander Hamilton Medal for public service, awarded to him by then-Treasury Secretary Henry M. Paulson, Jr., Moy served as the 38th Director of the United States Mint (2006–2011). Among many accomplishments during his tenure, Moy oversaw one of the largest increases in volume of precious metals output in Mint history, as Americans turned to safe-haven assets in the wake of the Great Recession.

Angela Roberts

CEO

Chief Executive Officer Angela Roberts joined U.S. Money Reserve in 2003. Roberts has held numerous positions within the organization, culminating in her promotion to CEO in 2015. She is credited with creating the analytic and KPI structure at U.S. Money Reserve. Believing strongly that the people make the business, Roberts has positioned U.S. Money Reserve to be a trusted precious metal leader that always puts their customers and employees first. Learn more in her interview with Forbes.

John Rothans

Master Numismatist

Chief Procurement Officer and Master Numismatist John Rothans has been a key fixture in the numismatic industry for over 30 years. Rothans joined U.S. Money Reserve as a consultant in 2004, eventually becoming Chief Procurement Officer and overseeing all wholesale operations, new product lines, and coin strategy. Rothans is credited with the development, production, and distribution of proprietary product offerings, including U.S. Money Reserve’s best-selling Pearl Harbor and Iwo Jima coin series.

Brad Chastain

Director of Education

Brad Chastain joined U.S. Money Reserve as Director of Education after spending 18 years at Vanguard, one of the world’s largest and most respected investment firms. As a leader in Vanguard’s employee plan retirement education business, Chastain managed a team of specialists and was responsible for helping hundreds of thousands of clients plan and prepare for retirement. He and his team provided in-depth training and education on a variety of financial topics ranging from investments, diversification and risk management, to Social Security, Medicare and College Savings Plans. An in-demand speaker and recognized industry thought leader in the areas of retirement planning and wealth management education, Chastain is dedicated to helping U.S. Money Reserve clients reach their financial goals and build more secure futures with precious metals.

Recent Articles

Silver & Gold in 2017: 6 Risks to Watch Out For

The year 2016 was undeniably interesting on many levels. Britain cast a monumental vote to leave the European Union, Russia allegedly hacked U.S. political party operations, multiple countries faced (and are facing) serious currency chaos, and Trump claimed the U.S. presidency, much to many people's surprise. In so many ways, 2016 was a...

6 Signs It Could Be Time to Buy Gold Bullion Coins

You may already know that the best time to find great deals on grills and patio furniture is at the end of summer, and that the best new car deals can be had at the end of the year, but what about when to buy gold bullion coins? Understanding how precious metals prices move isn't as simple as understanding patio furniture or car prices....

4 Reasons to Gift Gold & Silver This Holiday Season

During the holidays, nothing feels better than giving a gift you know is truly appreciated by the recipient. The perfect gift is thoughtful, meaningful, and both a joy to give and receive. You could even say that the perfect gift brings two people closer together. This holiday, give something that won't expire, go out of style, or...

How Changes in Islamic Law Could Impact the Price of Gold

The number of potential gold buyers in the world may have just increased by about 1.6 billion. For the first time in history, gold has been deemed an acceptable asset in Islamic finance. Owning gold used to be somewhat controversial for practitioners of Islam as Sharia law (which guides the personal and financial lives of Muslims) did...

Two Major Factors That May Send Silver Soaring in 2017

In a perfect world, you'd know with 100 percent certainty that your financial portfolio would carry your family through thick and thin, boom or bust, growth or recession. Unfortunately, such a world does not exist. A surprising election outcome has sparked cultural turmoil and a somewhat uncertain economic outlook. During such times of...

What a Trump Presidency Could Mean for Gold Buyers

After a dramatic campaign, Donald Trump garnered 62 more electoral votes than Hillary Clinton to become the 45th president of the United States. Now everyone's wondering...is this "Brexit for America" or a "time for America to bind the wounds of division," as Trump said in his first address as president-elect? In truth, only time will...

U.S. Money Reserve’s CEO on Trump’s Victory & the Price of Gold

By Angela Koch U.S. Money Reserve CEO You don't have to be a precious metals expert to know that the price of gold can fluctuate daily, especially when there’s a political curveball like Donald Trump thrown into the mix. The world is now watching to see how every crevice of the U.S. economy responds to Trump’s win. Will stocks continue...

Market Alert: Mounting Election Worries Send Gold over $1300/oz!

GOLD BREAKS $1,300/oz! Gold prices broke through the key level of $1,300 an ounce Wednesday morning, hitting a 1-month high. Uncertainty in the marketplace is only just beginning to rise. Lock in your gold before prices could move even higher! The outcome of the upcoming U.S. election is rattling markets as the gap continues to narrow...

The IMF Elevates China's Yuan: 4 Things to Know

On October 1, the International Monetary Fund (IMF) added the Chinese yuan to its special drawing rights (SDR) basket of currencies. If you've read these headlines, you likely have a few questions. What's the yuan? What does the IMF do? What does this mean for the U.S. economy, if anything at all? Read on to see what economists,...

A Long-Term Outlook on the Price of Silver

In July, silver made impressive gains on the coattails of Brexit, jumping to more than $20 an ounce to its highest level in roughly two years. Towards the end of August, however, prices dropped towards roughly $18 an ounce, but have steadily rebounded throughout September. While silver and gold have gained from the safe-haven rally...

Philip N. Diehl Appointed Chairman of the Industry Council for Tangible Assets

Current U.S. Money Reserve president and former U.S. Mint Director, Philip N. Diehl, was appointed chairman of the Industry Council for Tangible Assets (ICTA) at the association's Board of Director's meeting at the end of August. ICTA is a nonprofit association that supports the rare coin, paper money, and precious metals industry, with...

Weak Dollar & Pressured Economy Push Gold Higher

You've read the headlines. The dollar is slumping, interest rates aren't budging (or are they?), and the economy isn't performing as economists and financial analysts predicted. How are these elements contributing to the price of gold? Read on for a brief summary of how each could be bolstering the price and demand for this year's best...

Find hundreds of reports, articles, videos, and other useful tools to help you become a more educated precious metals owner.

Access Now

Stay up to date and get the latest news and updates impacting the gold and silver markets and precious metals industry.

Learn More