Executive Insights

Read valuable and timely articles from our executive team of experts to further your precious metals and coin knowledge.

Our Executive Authors

Philip Diehl

President

Philip N. Diehl is the president of U.S. Money Reserve and a published analyst of the precious metals markets. As 35th Director of the U.S. Mint (1994–2000), Diehl oversaw one of the most impressive government agency turnarounds in recent U.S. history through new product initiatives, increased oversight, strategic reorganization, and fiscal responsibility. His experience and expert knowledge in the field of precious metals strengthens U.S. Money Reserve’s commitment to a superior customer experience.

Edmund C. Moy

Senior IRA Strategist

Edmund C. Moy collaborates with U.S. Money Reserve as Senior IRA Strategist. A recipient of the Alexander Hamilton Medal for public service, awarded to him by then-Treasury Secretary Henry M. Paulson, Jr., Moy served as the 38th Director of the United States Mint (2006–2011). Among many accomplishments during his tenure, Moy oversaw one of the largest increases in volume of precious metals output in Mint history, as Americans turned to safe-haven assets in the wake of the Great Recession.

Angela Roberts

CEO

Chief Executive Officer Angela Roberts joined U.S. Money Reserve in 2003. Roberts has held numerous positions within the organization, culminating in her promotion to CEO in 2015. She is credited with creating the analytic and KPI structure at U.S. Money Reserve. Believing strongly that the people make the business, Roberts has positioned U.S. Money Reserve to be a trusted precious metal leader that always puts their customers and employees first. Learn more in her interview with Forbes.

John Rothans

Master Numismatist

Chief Procurement Officer and Master Numismatist John Rothans has been a key fixture in the numismatic industry for over 30 years. Rothans joined U.S. Money Reserve as a consultant in 2004, eventually becoming Chief Procurement Officer and overseeing all wholesale operations, new product lines, and coin strategy. Rothans is credited with the development, production, and distribution of proprietary product offerings, including U.S. Money Reserve’s best-selling Pearl Harbor and Iwo Jima coin series.

Brad Chastain

Director of Education

Brad Chastain joined U.S. Money Reserve as Director of Education after spending 18 years at Vanguard, one of the world’s largest and most respected investment firms. As a leader in Vanguard’s employee plan retirement education business, Chastain managed a team of specialists and was responsible for helping hundreds of thousands of clients plan and prepare for retirement. He and his team provided in-depth training and education on a variety of financial topics ranging from investments, diversification and risk management, to Social Security, Medicare and College Savings Plans. An in-demand speaker and recognized industry thought leader in the areas of retirement planning and wealth management education, Chastain is dedicated to helping U.S. Money Reserve clients reach their financial goals and build more secure futures with precious metals.

Recent Articles

Tips for Selecting a Self-Directed IRA Custodian

To hold physical gold and silver in a Self-Directed IRA, you are required by the IRS to open an account with an approved custodian and have the custodian purchase precious metals on your behalf. But there are so many custodians to choose from. And what’s all this you hear about promoters and administrators? Learn how to evaluate IRA...

What Are Alternative Assets?

Are you stuck in the same old rut of adding stocks and bonds to your retirement portfolio? It might be time to learn about another asset category—alternative assets. We explain what they are, how they’re different from traditional assets, and how you can work them into your retirement portfolio for greater diversification. What Are...

Finding Safety in Uncertainty

The unfortunate truth is, we are still facing many of the same challenges we faced back in March. While some things may have improved, it’s important that we don’t get locked into complacency. The COVID-19 crisis is ongoing here in the United States, and people are still suffering. The number of new cases of coronavirus remains...

5 Easy Steps to Start Building a Precious Metals Portfolio

You’ve likely heard that gold prices are climbing and silver prices are keeping pace with gold. The price of gold has held above the $1,800/oz. mark, and the price of silver rose to its highest level in nearly three years on Monday, July 13, 2020. Does this mean you’re missing out on a potential opportunity to grow your own wealth? You...

Watching the Experts

With some disasters, there are warnings you can observe before the disaster is even apparent. I remember one such warning from when I grew up in the heartland of the country, Nebraska farm country. I remember seeing trouble was coming because of a group of birds. Normally, farmers want birds out of their crops. The fields are cared for...

No 401(k) at Work? 4 Other Ways to Save for Retirement

Contributing to an employer-provided 401(k) retirement plan is often touted as one of the best retirement strategies. However, approximately 55 million Americans don’t have access to such a plan. Are you among those with no 401(k) at work? If so, it’s still possible to take charge of your retirement savings—sometimes with options that...

June 2020 Update to Required Minimum Distribution Rules

The IRS has added a twist to the rules for required minimum distributions from retirement accounts—a twist that could benefit you. The IRS announced the change on June 23. “Anyone who already took a required minimum distribution (RMD) in 2020 from certain retirement accounts now has the opportunity to roll those funds back into a...

How Stable Are Your Holdings?

It’s common to look to the stock market as a source of growth for your wealth. Many people feel right now is a good time to get back in after this year’s earlier shock. Given the circumstances, the market appears to be rather stable—at least for now. However, you might be wondering if now is a good time to re-enter the stock market. No...

Straightforward Answers to 7 Common IRA Questions

Lack of knowledge is a major reason many Americans don’t open an IRA. Research from the LIMRA Secure Retirement Institute found that of those who don’t have an IRA, 46 percent feel they do not understand enough about IRAs to contribute to them. Where do you fall on the IRA-knowledge spectrum? If you’re still in research mode, check out...

Thoughts on the Declaration of Independence

The Fourth of July is this weekend, one of the most important holidays and one of my favorites. It’s just in time for it, too. Our country has faced some tremendous challenges this year. On top of everything else, political tensions are at a boiling point. However, at times like this, it’s important to remember that we are all...

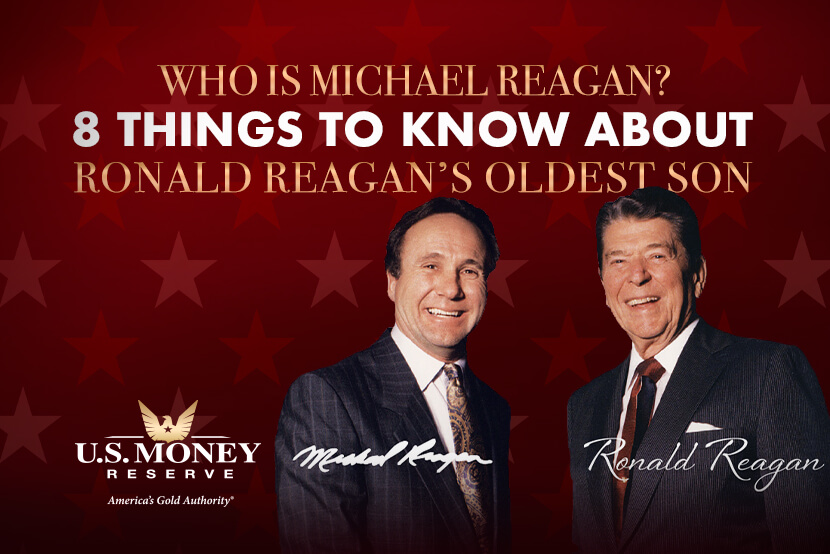

Who Is Michael Reagan? 8 Things to Know About Ronald Reagan's Oldest Son

He debated Mikhail Gorbachev and set five world records in powerboat racing. He’s written several books and raised millions of dollars for charities, including the U.S. Olympic Team, the Cystic Fibrosis Foundation, the Juvenile Diabetes Research Foundation, and the Statue of Liberty-Ellis Island Foundation. He’s Michael Reagan, and he...

Could Inflation Pop the Dollar?

Certain stories come to mind when people talk about inflation. Perhaps the most infamous is the hyperinflation of the German Mark in the 1920s: pictures of Marks being used as wallpaper, being burned as kindling for warmth, and even being played with by children using blocks of Marks piled into stacks. Such images seem far removed from...

Find hundreds of reports, articles, videos, and other useful tools to help you become a more educated precious metals owner.

Access Now

Stay up to date and get the latest news and updates impacting the gold and silver markets and precious metals industry.

Learn More