Gold has once again been making headlines as the nation’s financial markets continue to face uncertainty. On April 22, 2022, Barron’s reported that gold had made yet another run at $2,000/oz., nearing its all-time-high reached in August 2020. That same day, Barron’s...

Is Gold a Commodity? Yes, But It’s Not a Traditional Commodity.

When we think of commodities, our minds might immediately drift to products like crude oil, coal, corn, and sugar. We might call these the “dictionary definition” of commodities. Gold, too, is a longstanding commodity, though I hold that gold is not a “traditional”...

Bars, Bullion & Coins: Which Type of Silver Could Be Right for You?

Like gold coins, silver coins have been a commonly accepted form of currency for thousands of years. Silver was first used as a currency in 700 B.C., notes The Silver Institute, and has long held a special place in currencies around the world, from the Greek drachma...

Signs the Economy Is Weaker Than Yellen Let On At Jackson Hole

Markets were quiet last week as they awaited Federal Reserve Chair Janet Yellen's comments at Jackson Hole, Wyoming. In short, she stated that "the case for an increase in the federal funds rate has strengthened in recent months," thanks to "continued solid...

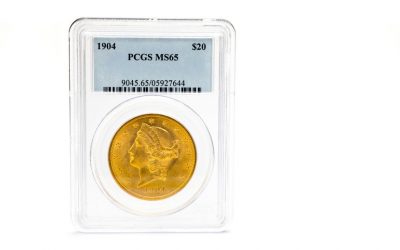

6 Simple Tips for Buying Certified Coins

For those mindful of their wealth, gold coins are a means of diversifying away from paper-based assets, such as stocks and mutual funds. Certified coins, in particular, are ideal for those in search of long-term profit potential. If you're new to buying certified...

The Price of Gold: Demystified by Philip N. Diehl

Gold prices seem to move in mysterious ways, but over the long term, a few forces account for most of these price changes. For those of us who buy gold and and hold onto it for a year or longer, these are the most important factors to bear in mind as we make our...

If you follow gold, it bears to keep an eye on China

I occasionally go back through my blog posts to see how my predictions bore up after a year or so. This can be humbling, but sometimes you get it right. I'll leave it to others to dig up the ones where I missed the mark. In August 2013, The Wall Street Journal Online...

The South Carolina primary, one day out

I follow politics pretty closely. Back in November, I saw an article in FiveThirtyEight in which the author argued that the GOP’s primary and caucus rules doom the outsider candidates—Donald Trump, Ted Cruz, and Ben Carson—by tilting the playing field in favor of the...

Is gold’s recent rally a sign you should be worried?

Gold prices have soared $150 per ounce since the first of January and, if prices rise another $60, the yellow metal will officially cross the threshold into bull market territory. Gold is soaring because investors around the world are panicking about the state of the...

China Turns to Gold

Greater risk of instability can only increase the precious metal's luster. By Philip Diehl Aug. 13, 2013 12:55 p.m. ET Concerns are rising that the Chinese economy is headed for a hard landing. That would have implications for many markets, not least for gold....

Developments in Ukraine — and gold

In my last post, I wrote about prospects for civil war in Ukraine turning into a direct confrontation between Russia and the West, and what that would mean for gold prices. I said that markets had not yet woken up to this reality and when they did, gold prices would...

What Does War in Ukraine Mean for Gold?

What is the connection between the price of gold and civil war in Ukraine? Simple—gold has long been a refuge in times of political turmoil. When investors and savers realize the severity of a threat to their wellbeing, they rush to gold to protect their wealth,...